Initiatives for society Improving services offered

Basic policies concerning customer-centered business operations

Status of fulfilling a financial intermediary function

Comprehensive financial services

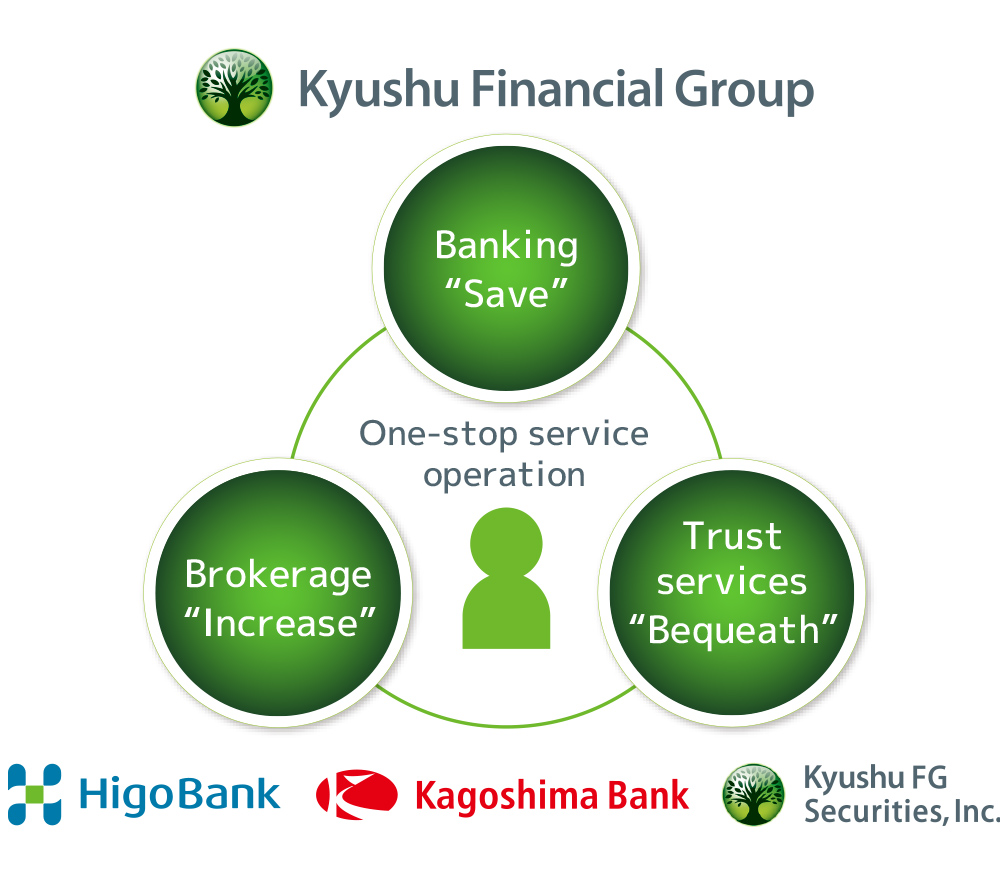

Comprehensive banking, brokerage, and trust services

To respond to growing needs related to inheritance and succession of assets in the aging society, the Group in April 2019 commenced trust services at the bank, the first of its kind among regional bank groups in Kyushu.

Also, KFG Securities responds to various customer needs for asset management by expanding its financial products and services such as online trading.

This initiative has enabled the collaboration between banking, brokerage, and trust services and allows us to provide one-stop services according to customer needs related to their lifecycles and inheritance, among others. Both banks and Kyushu FG Securities are working together effectively to provide more specialized financial products and services.

Providing adult guardianship deposit account

With the aging population, the ratio of people suffering from dementia is increasing. In response to this situation, the Group launched the Adult Guardianship Deposit Account on July 1, 2020.

This deposit account is available to customers using the adult guardianship system (i.e., adult ward) to manage their money set aside from money enough to pay their living expenses. Opening of accounts and all account transactions, including depositing, withdrawing, and cancellation, require a directive issued by a family court. It ensures a ward’s properties to be managed in a highly transparent and appropriate manner.

Providing IPO support services

Kyushu FG Securities worked with Higo Bank and Kagoshima Bank to launch IPO support services on October 1, 2020 for customers aiming for initial public offering. We will support Kyushu-based regional companies with their IPO initiatives.

Improving services through digitalization

Use of tablets

We have introduced a system using tablets for some operations, such as keeping customers’ passbooks, cash, and other items, procedures related to deposited assets, and opening new accounts at branches, so that it takes less time and effort for customers to fill in documents, reduces our administrative operations, and promotes the paperless initiative.

Operational reforms

We centralize some of the branch operations, including the opening of new accounts, to reduce customers’ waiting time and branches’ administrative operations.

Efforts to Improve Customer Satisfaction

Barrier-free initiatives

comuoon / Voice Messe

We are introducing barrier-free facilities in its branches to create a comfortable environment for all our customers.

We are improving our services to cater to the various needs of our customers. All our branches have introduced a tabletop hearing assistance device called “comuoon” and a mobile hearing aid called “Voice Messe” which make bank staff’s voice clear so that customers can hear smoothly.

Operating banks on wheels

Bank on wheels

We have introduced bank on wheels to improve customer convenience and ensure business continuity during times of disaster. Using this service, we provide financial services in the areas with few bank branches and respond to emergency situations caused by disasters to help residents in our local community.

We sent our bank on wheels to areas affected by the heavy rains in July 2020.

Expanding and improving non-face-to-face channels

We are enhancing ATM functions and online transactions to improve customer convenience and the Group’s productivity.

Enhancing ATM functions

In addition to the basic functions such as depositing, withdrawing, and recording transactions on passbooks, we are enhancing ATM functions to improve customer convenience, including dealing with cash cards’ magnetic malfunction, address change procedures, and displaying in English for international customers.

Use of the internet

We are working to improve customer convenience and take less time and effort for transactions. We have introduced a system to ask customers to prepare in advance application forms and vouchers for personal loans, including auto loans and education loans, to reduce their waiting time at branches.